How to Test Sensors and Hardware on Raspberry Pi (No Code Required)

If you build Raspberry Pi projects, you’ve probably run into this situation:

You connect a sensor… then write a test script.

You wire a relay… then write GPIO code.

You try RS-485… then debug serial communication.

Before long, half your time is spent writing small test programs just to verify that your hardware works.

The Top HAT Dashboard was created to simplify this process.

Using the Top HAT Dashboard for Fast Raspberry Pi Hardware Testing

If you enjoy building Raspberry Pi projects, experimenting with sensors, or creating DIY automation systems, one problem shows up quickly:

Testing hardware takes time.

You connect a sensor… then write a test script.

You wire a relay… then write GPIO code.

You try RS-485… then debug serial communication.

Before long, the fun part — building your project — gets buried under setup work.

The Top HAT Dashboard solves that.

GitHub Repository:

https://github.com/Cirkitscape/Top_HAT_Dashboard

It’s a self-hosted Raspberry Pi dashboard designed for hobbyists who want to quickly test sensors, relays, and communication devices without writing code.

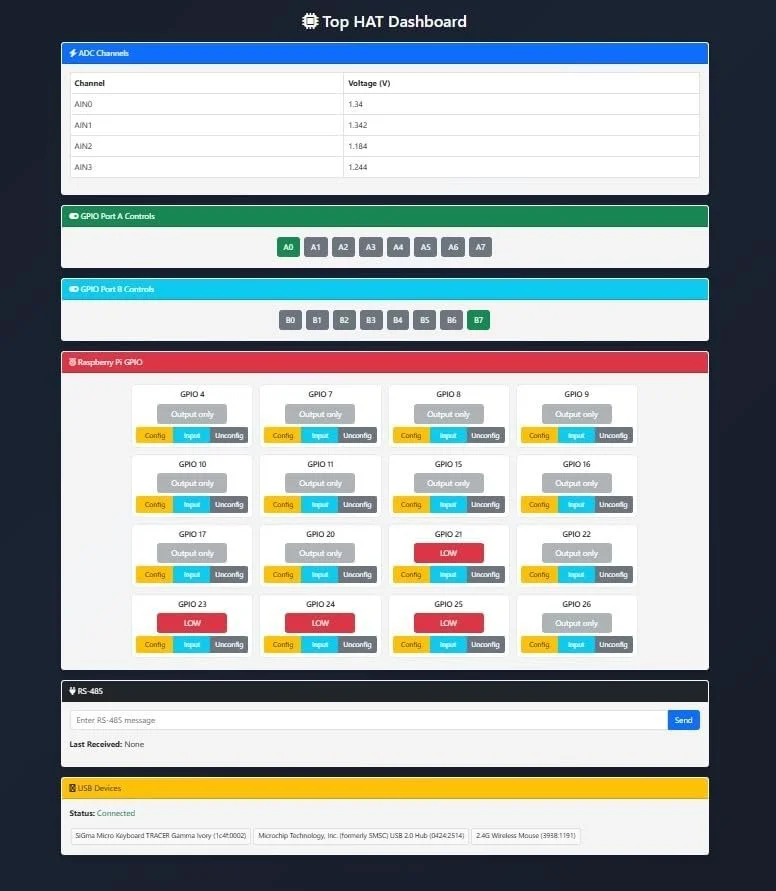

With the Top HAT Dashboard you can:

Monitor sensors instantly

Toggle outputs from your browser

Test RS-485 / Modbus devices

View connected USB devices

Control everything through a simple web interface

Just connect your hardware, open your browser, and start testing.

What Is the CirkitScape Top HAT?

The CirkitScape Raspberry Pi Top HAT Expansion Board is a Raspberry Pi expansion board designed to make it easier to connect sensors, devices, and automation hardware.

Instead of combining multiple breakout boards or writing custom hardware test programs, the Top HAT adds several useful capabilities directly to the Raspberry Pi, including:

Analog sensor inputs for monitoring voltage-based sensors

Digital GPIO control for outputs and devices

RS-485 communication for Modbus and industrial sensors

USB connectivity for additional peripherals

The board mounts directly on top of the Raspberry Pi as a standard Raspberry Pi HAT, turning the Pi into a powerful hardware testing and automation platform.

For hobbyists, this means you can quickly connect hardware and start experimenting without designing custom electronics.

What Is the Top HAT Dashboard?

The Top HAT Dashboard is a local web interface that runs directly on your Raspberry Pi.

Once installed, you open a browser and get a control panel where you can:

View live analog sensor readings

Toggle digital outputs

Send RS-485 commands

Monitor USB devices

Check system status

Everything runs locally on the Raspberry Pi.

There are:

No cloud services

No subscriptions

No internet requirement

It’s a self-hosted Raspberry Pi hardware dashboard designed for testing and experimentation.

Image of Screenshot

Quickly Test Sensors Without Writing Code

One of the most frustrating parts of hobby electronics is needing to write code just to test a sensor.

Normally you would need to:

Install Python libraries

Write a script to read the sensor

Print values to the terminal

Debug wiring issues

With the Top HAT Dashboard, you skip all of that.

Just:

Connect your sensor

Power the Raspberry Pi

Open the dashboard in your browser

You instantly see the sensor readings.

This makes the dashboard an excellent Raspberry Pi sensor testing tool for hobbyists.

Debug Raspberry Pi Hardware Easily

The dashboard is also extremely useful when debugging Raspberry Pi projects.

When something isn’t working, it’s often unclear whether the problem is:

Wiring

Software

Communication

The sensor itself

Using the dashboard you can quickly:

Verify analog voltage readings

Toggle outputs to confirm relays work

Test RS-485 communication

Confirm connected USB devices

This makes the Top HAT Dashboard a powerful hardware debugging tool for Raspberry Pi projects.

Instead of guessing what might be wrong, you can quickly confirm whether the hardware is working correctly.

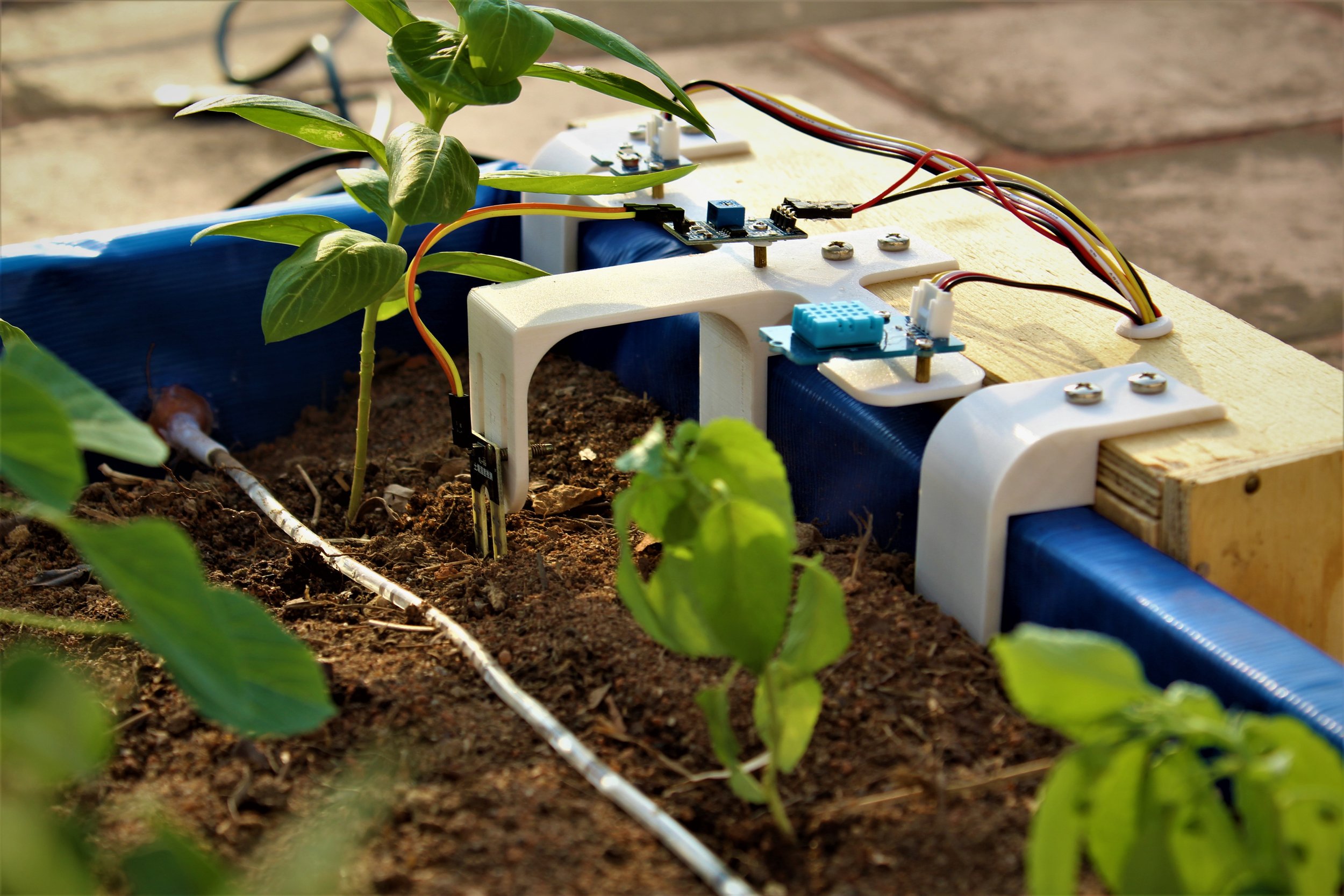

Example Project: Smart Garden Controller

Imagine building a Raspberry Pi smart garden system.

Without a dashboard you would need to:

Write a soil moisture sensor script

Create relay control logic

Build a small web interface

With the Top HAT Dashboard:

Connect the soil sensor

Connect the pump relay

Open the dashboard

You can immediately test the sensor and control the pump from your browser.

This allows hobbyists to validate hardware before writing any custom code.

Test RS-485 and Modbus Devices

Many hobbyists want to experiment with RS-485 communication or Modbus sensors, but communication setup can be complicated.

The Top HAT includes built-in RS-485 capability.

The dashboard allows you to:

Send test messages

Receive responses

Verify communication with sensors

Experiment with multi-device networks

This makes it a great learning platform for industrial communication with Raspberry Pi.

Fully Local Raspberry Pi Dashboard

Everything runs directly on your Raspberry Pi.

That means:

No internet required

No cloud dashboards

No subscription costs

Full control over your project

For makers who prefer self-hosted tools, this is a major advantage.

Perfect for Raspberry Pi Hobby Projects

The Top HAT Dashboard works great for projects such as:

Raspberry Pi smart garden controllers

DIY greenhouse automation

Home automation experiments

Sensor monitoring dashboards

Workshop relay control systems

STEM electronics learning labs

It helps hobbyists test hardware quickly and build projects faster.

Frequently Asked Questions

How can I test sensors on Raspberry Pi without writing code?

You can use a web dashboard like the Top HAT Dashboard. It allows you to connect sensors and instantly view readings through a browser without writing custom scripts.

How do you debug Raspberry Pi hardware connections?

You can debug hardware by checking live sensor readings, toggling GPIO outputs, and verifying device communication. Tools like the Top HAT Dashboard provide a visual interface for testing these connections.

What is RS-485 used for with Raspberry Pi?

RS-485 is commonly used for industrial sensors and Modbus devices. It allows reliable communication over longer cables and supports multiple devices on the same communication bus.

Can Raspberry Pi be used for hardware testing?

Yes. Raspberry Pi is widely used as a hardware testing and prototyping platform for sensors, automation systems, and IoT projects. Dashboards and monitoring tools make testing hardware much easier.

Final Thoughts

For Raspberry Pi hobbyists, the hardest part of a project is often the setup.

The Top HAT Dashboard makes hardware testing simple by providing:

A ready-to-use Raspberry Pi dashboard

Instant sensor monitoring

Easy output control

RS-485 testing tools

A fast way to debug hardware

Instead of writing setup code, you can focus on what matters most — building.

Explore the project:

https://github.com/Cirkitscape/Top_HAT_Dashboard

Plug it in.

Open the dashboard.

Start testing your next Raspberry Pi project.

Can You Train AI Models on a Raspberry Pi?

(Spoiler: Kind of… but let’s talk about it.)

When people hear “AI” and “Raspberry Pi” in the same sentence, they usually picture tiny robots, face detection demos, or maybe voice recognition with Home Assistant.

But what if you want to go further?

Can you actually train machine learning models on a Raspberry Pi?

The short answer: kind of.

The long answer: it depends on what you’re training, why you’re training it, and which Pi you’re using.

This article breaks down what’s really possible, what’s not worth your time, and the smart ways to use a Raspberry Pi in machine learning projects.

What Does “Training” Really Mean?

Before diving in, let’s separate two key concepts in machine learning:

Training – creating a new model from raw data (compute-heavy, memory-intensive).

Inference – running a pre-trained model to make predictions.

The Raspberry Pi is fantastic for inference—especially when paired with accelerators like the Google Coral USB or Hailo-8 AI module.

But training models on a Pi? That’s where things get challenging.

Can the Raspberry Pi Actually Train AI Models?

Yes—under certain conditions.

What You Can Train on a Raspberry Pi:

Lightweight models with small datasets (e.g. linear regression, decision trees).

TinyML networks like MobileNet, SqueezeNet, or TinyLlama (especially when fine-tuning).

Scikit-learn algorithms (KNN, SVM, random forest with small input sizes).

Custom classifiers through transfer learning (retraining the last layer of a CNN).

What You Shouldn’t Try to Train on a Raspberry Pi:

Full transformer-based LLMs like GPT, BERT, or Falcon (from scratch).

Deep convolutional neural networks (e.g. ResNet-50 on ImageNet).

Reinforcement learning environments with large updates.

Any training involving large batches or complex matrix math.

Put simply: the Pi can train something, but large-scale AI training will take weeks or months and quickly wear out your storage.

Realistic Training Scenarios for Raspberry Pi

If you’re determined to train on a Pi, these are the most practical use cases:

1. Retraining for Edge AI (TinyML)

Want to adapt an existing TensorFlow Lite model for your own dataset?

For example, retraining MobileNet to detect apples vs oranges in your warehouse.

On the Raspberry Pi, you can:

Collect images with the Pi camera.

Preprocess them directly on the Pi.

Retrain only the final layer with transfer learning.

Export a quantized

.tflitemodel for deployment.

This is a sweet spot for custom edge classifiers.

2. On-Device Data Collection & Preprocessing

Even if you don’t fully train models on the Pi, it excels at:

Gathering real-world data from sensors, cameras, or microphones.

Performing preprocessing like downsampling, segmentation, or augmentation.

Exporting clean datasets for GPU/cloud training later.

This ensures your training data is tailored to your deployment environment.

3. Federated Learning & Local Updates

In a federated learning setup, the Pi can:

Receive a global model from a server.

Train locally on private data.

Send updated weights back—without sharing raw data.

This approach works well for:

Privacy-focused smart homes.

Medical monitoring devices.

Industrial IoT sensors.

The Pi doesn’t carry the whole burden but still contributes meaningfully to distributed learning.

Limitations: What Holds the Pi Back

Training on a Raspberry Pi isn’t without hurdles:

CPU & RAM Bottlenecks

Raspberry Pi 4B: Quad-core Cortex-A72, 1–8 GB RAM.

Raspberry Pi 5: More powerful, but still nowhere near a GPU-equipped PC.

Heavy swapping and thermal throttling slow things down.

Storage Wear

SD cards degrade quickly under constant writes.

Use an SSD via USB 3.0 or M.2 if you plan repeated training.

Time Cost

Even small neural networks may take hours or days.

Larger models are simply impractical.

Tools That Make Training Possible

For those who want to experiment:

TensorFlow Lite – best for deployment, light training with transfer learning.

Scikit-learn + NumPy – great for traditional ML methods.

ONNX Runtime – supports small models on ARM CPUs.

TinyML frameworks – like MicroTVM, CMSIS-NN, or TinyMLgen.

AI accelerators (Coral, Hailo, Intel Movidius) speed up inference only, not training.

The Smarter Strategy: Train Elsewhere, Run on Pi

If your goal is to use AI effectively on the Raspberry Pi, here’s the professional approach:

Train your AI model on a PC, GPU workstation, or cloud platform.

Optimize & quantize the model using TensorFlow Lite Converter or ONNX.

Deploy it on the Raspberry Pi for inference.

This way, your Pi becomes a lightweight inference engine rather than a bottleneck.

Final Thoughts: Is It Worth Training on a Raspberry Pi?

So—can you train AI models on a Raspberry Pi?

Yes, technically.

But should you? Only for small, targeted, or experimental tasks.

The Raspberry Pi shines in deployment and edge inference:

Smart sensors

IoT edge nodes

Privacy-first AI assistants

Real-world data collectors

For heavy training, stick to a GPU or the cloud. For edge AI deployment, the Pi is one of the best low-cost platforms in the world.

10 Surprisingly Powerful Projects You Can Build with Raspberry Pi

...and why it’s no longer just for tinkerers

For years, the Raspberry Pi carried the reputation of being a low-cost board for classroom coding exercises, blinking LEDs, and retro gaming projects. While that may have been true in its early days, the platform has since grown into one of the most versatile, affordable, and underestimated development tools available today.

With the release of newer Pi models—combined with an ever-growing ecosystem of add-on boards, software frameworks, and community support—the Raspberry Pi has moved well beyond hobby tinkering. It is now being used for industrial prototyping, AI deployment, automation, and even lab research.

Below, we’ll walk through 10 surprisingly powerful projects you can build with Raspberry Pi—covering real-world applications, design tips, and the hardware/software stack needed to make them successful.

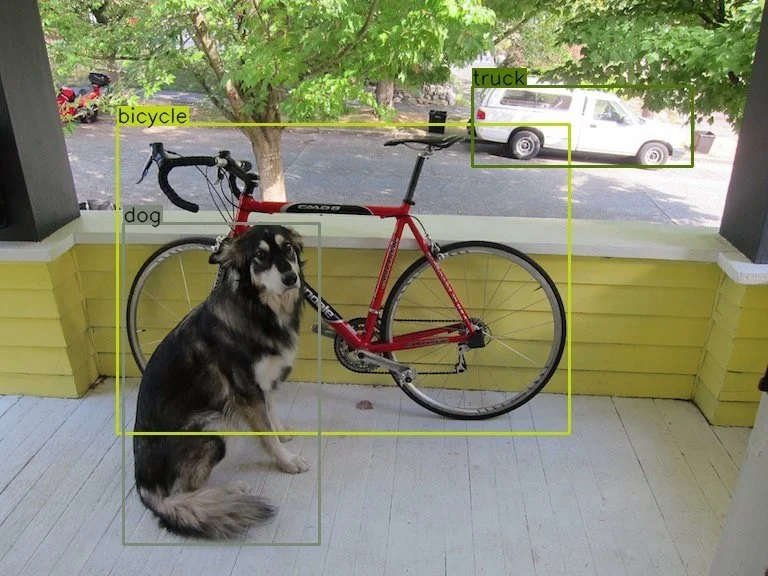

1. Edge AI Object Detection

AI at the edge no longer requires large GPUs or expensive cloud subscriptions. With Raspberry Pi 4 or Pi 5, paired with accelerators like Google Coral TPU or the Hailo-8 M.2 module, you can run real-time inference locally.

Using frameworks such as:

TensorFlow Lite

YOLOv5 via OpenCV

MediaPipe

…you can create systems that detect faces, track movement, recognize license plates, or identify specific objects on the fly.

Practical applications include:

Wildlife detection cameras that operate without an internet connection

Real-time object counters for factories and retail spaces

Smart parking systems capable of license plate recognition

The Pi’s affordability means AI solutions that once required cloud subscriptions can now run entirely offline, improving both privacy and reliability.

Object detection example of a dog, bicycle, and a truck.

2. Industrial Data Logger with RS-485

Legacy systems aren’t going away anytime soon. Many industrial sensors, HVAC units, and PLCs still rely on RS-485 communication—a protocol the Raspberry Pi can handle with the right HAT or interface.

With Python libraries like minimalmodbus or pymodbus, Raspberry Pi can act as a:

Data logger for temperature, humidity, or energy meters

Protocol bridge between Modbus RTU and MQTT

Diagnostic tool for troubleshooting legacy equipment

Example use case: A Pi-based Modbus logger installed in a warehouse can continuously track environmental conditions and push the data to an IoT dashboard, making monitoring both affordable and scalable.

For developers and engineers, boards like the Top HAT combine RS-485 with GPIO expansion, ADCs, and power management—making industrial prototyping faster and more reliable.

3. Home Automation Gateway

Commercial smart home hubs often come with vendor lock-in and cloud dependency. Raspberry Pi, running Home Assistant or OpenHAB, gives you full control of your smart home—without giving up privacy.

A Pi-based hub allows you to:

Control Zigbee, Z-Wave, BLE, and Wi-Fi devices from one interface

Automate lights, HVAC, security systems, and appliances

Run all automations locally, ensuring they still work without internet

Optionally integrate with Alexa or Google Assistant

This approach keeps ownership of your data and rules in your hands. Many enthusiasts now prefer Raspberry Pi as the backbone of their privacy-first smart homes.

4. Personal Private Cloud

Want your own secure alternative to Google Drive or Dropbox? With a Raspberry Pi, you can deploy a full private cloud solution.

Popular tools include:

Nextcloud for file syncing, document editing, and collaboration

Pi-hole to block ads and trackers across your network

WireGuard or Tailscale for encrypted remote access

Apache or Nginx for hosting personal websites or dashboards

Pair your Pi with a USB 3.0 SSD or an M.2 expansion to increase both speed and storage capacity. The result is a compact, self-hosted server that protects your data while remaining accessible from anywhere.

5. Retro Gaming Console

One of the most famous Pi projects is retro gaming, but it has grown far beyond NES emulation. With distributions like RetroPie and Batocera, you can emulate systems including:

NES, SNES, and Sega consoles

PlayStation 1

Game Boy and Game Boy Advance

Select N64 and PSP games (on Pi 4/5)

Hobbyists frequently 3D print cases, build handheld consoles, or even design full arcade cabinets around Raspberry Pi hardware—blending nostalgia with modern DIY design.

Screen shoot of Pac-Man game play.

6. Environmental Monitoring Station

Raspberry Pi is ideal for scientific data logging thanks to its low power requirements, GPIO access, and compatibility with sensors.

With sensors like the DHT22 (temperature/humidity), BMP180 (barometric pressure), MQ135 (air quality), and soil moisture probes, you can build:

Greenhouse monitoring systems

Pollution and air quality studies

Microclimate weather stations

Smart agriculture tools

By adding LoRa radios or cellular modules, Pi-based stations can transmit data from remote or off-grid environments, powered by solar panels and batteries.

7. Wildlife or Security Camera

Raspberry Pi with a camera module or USB webcam can function as a smart surveillance system.

Capabilities include:

Streaming video via MJPEG or RTSP

Recording when motion is detected

Uploading clips to a NAS or personal server

Capturing time-lapse sequences over long periods

Adding OpenCV or TensorFlow allows you to filter motion events by object type—meaning your system can ignore false triggers from pets or wind-blown branches while alerting you only to relevant movement.

Security footage example

8. Digital Signage Display

Raspberry Pi has become a go-to replacement for dedicated signage controllers. Its fanless design, small size, and affordability make it ideal for commercial installations.

Software options like Screenly, InfoBeamer, and Yodeck let you run:

Storefront advertisements

Restaurant menu boards

Conference/event screens

Real-time business dashboards

This approach reduces cost while providing a flexible, scalable signage system.

9. Lab Automation and Test Bench Control

In labs and test environments, Raspberry Pi shines as a bridge between software and physical hardware.

Through GPIO, I²C, and SPI, you can:

Automate calibration procedures

Build functional test stations for electronics

Perform power cycling during endurance testing

Collect analog and digital data with add-on ADC/DAC boards

The ability to control equipment directly from Python scripts or shell commands makes Raspberry Pi an invaluable tool for engineers and researchers.

10. Offline AI Chatbot Assistant

Running AI models locally is now possible thanks to Raspberry Pi 5’s improved hardware. By leveraging lightweight frameworks such as Llama.cpp, Ollama, or GPT4All, you can create an offline AI assistant that:

Recognizes voice commands with Whisper

Responds through text or voice output

Assists with coding, research, and automation tasks

Runs entirely without an internet connection

This setup provides a private alternative to cloud AI assistants, with enough capability for productivity, coding support, and lightweight conversational tasks.

Screen shot of Ollama web UI

Bonus: Expand Raspberry Pi’s Capabilities

Out of the box, Raspberry Pi has limitations—such as no built-in analog inputs, limited GPIO, and no RS-485 interface. Expansion boards like the Top HAT address these gaps by adding:

Extra GPIO expanders

RS-485 communication for industrial use

ADC channels for sensor inputs

A USB hub for peripheral management

Power path management with battery support

Instead of juggling multiple add-ons, you get a single, integrated board that transforms Raspberry Pi into a rugged prototyping platform.

Final Thoughts

Raspberry Pi has evolved from a teaching tool into a serious platform for prototyping and product development. From edge AI and automation to environmental science and industrial integration, it enables projects once limited to high-budget labs or enterprises.

Whether you’re an engineer building an MVP, a researcher monitoring field data, or a maker experimenting with AI, Raspberry Pi provides the flexibility, scalability, and affordability to bring ideas to life.

With the right hardware expansions, you’re not just building projects—you’re building solutions.

Can Raspberry Pi Power Your Next Industrial Prototype?

For over a decade, the Raspberry Pi has been a favorite tool for hobbyists, students, and makers—powering everything from coding lessons to retro gaming consoles. But in recent years, the Pi has stepped into a new arena: industrial prototyping and edge computing.

So here’s the real question: Can a $35–$75 Raspberry Pi really handle industrial-grade projects?

For over a decade, the Raspberry Pi has been a favorite tool for hobbyists, students, and makers—powering everything from coding lessons to retro gaming consoles. But in recent years, the Pi has stepped into a new arena: industrial prototyping and edge computing.

So here’s the real question: Can a $35–$75 Raspberry Pi really handle industrial-grade projects?

Spoiler: Yes—if you equip it the right way.

The Case for Raspberry Pi in Industrial Prototyping

At first glance, the Raspberry Pi doesn’t look like an industrial controller. It lacks rugged enclosures, DIN rail mounts, and screw terminals. But underneath, it offers:

A full Linux OS (Debian, Ubuntu, Yocto) with automation support

Built-in GPIO, UART, I²C, and SPI interfaces

Support for modern frameworks like Python, Node-RED, MQTT, Docker, and Kubernetes

An enormous open-source community and documentation

In short, Raspberry Pi is a low-cost, highly customizable platform—and for prototyping industrial systems, flexibility is more valuable than specialized hardware.

Real-World Industrial Applications

Here are some practical ways engineers and developers are already using Raspberry Pi in industry:

Process Monitoring – Collect sensor data (temperature, vibration, pressure) via I²C or SPI

Predictive Maintenance – Run machine learning models at the edge to detect anomalies in motors or pumps

Legacy Bus Control – Communicate with Modbus RTU (RS-485) or CAN-enabled devices

IoT Gateways – Securely bridge field devices to the cloud over MQTT or HTTPS

Human-Machine Interfaces (HMI) – Power dashboards and touchscreen displays for operators

These use cases prove the Pi isn’t just a toy—it’s a capable prototype platform for Industry 4.0 projects.

Limitations of Raspberry Pi in Industrial Settings

Despite its versatility, the Raspberry Pi wasn’t designed for rugged environments. Common pain points include:

No analog inputs (ADC required)

GPIOs vulnerable to voltage spikes

No native RS-485 or CAN transceivers

MicroSD card wear from constant logging

This is where most DIY Pi projects break down. Without the right expansion hardware, you end up with a tangle of HATs and breakout boards—not a production-ready prototype.

The Solution: Raspberry Pi Expansion Boards

To unlock industrial capability, you need a single, consolidated expansion board that adds all the missing features.

Meet the Top HAT

The Top HAT is an industrial expansion board that transforms the Raspberry Pi into a deployment-ready prototyping system:

RS-485 Support – Native Modbus RTU and custom serial communication

Analog Inputs (ADC) – Read real-world sensors with precision

GPIO Expansion – Drive relays, LEDs, and isolated digital IO

Integrated USB Hub – Expand connections for data logging or wireless modules

Instead of stacking multiple HATs, the Top HAT provides a single industrial-grade interface layer.

Prototype Fast, Scale Smarter

With the Top HAT, your Raspberry Pi becomes more than a development board—it becomes a launchpad for real-world solutions. Whether you're in the lab or on the factory floor, you can:

Build and test prototypes in hours, not weeks

Validate industrial sensors and protocols quickly

Scale your software stack with Linux tools and Docker

Transition later to a custom board or hardened industrial PC

This workflow keeps costs low and iteration cycles fast—perfect for startups, engineers, and R&D teams.

Final Thoughts

The Raspberry Pi may not be industrial out of the box, but with the right expansion hardware, it’s a serious contender for industrial prototyping.

Whether you’re building a smart factory tool, an IoT gateway, or a process automation system, the Pi can help you move from concept to prototype faster than traditional industrial PCs.

And with solutions like the Top HAT, you don’t need to cobble together multiple HATs—you get a clean, reliable platform ready for real-world testing.

Want to see how the Top HAT can level up your Raspberry Pi? Check out the product page here or get in touch for more details.

UART vs SPI vs I2C: Which Protocol Should You Actually Use?

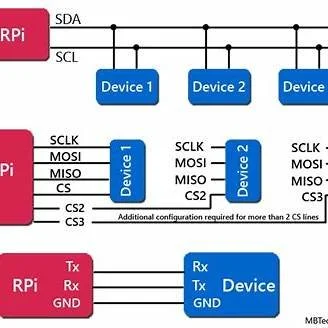

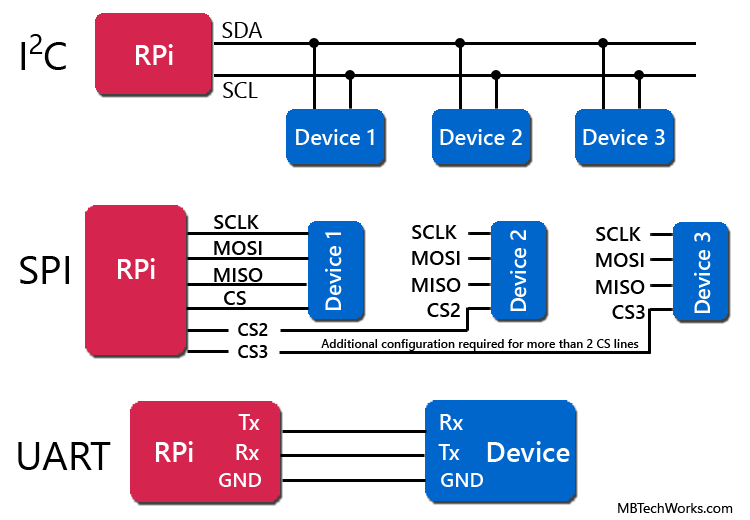

If you've ever stared at a microcontroller datasheet wondering whether to use UART, SPI, or I2C for your next project, you're not alone. These three serial communication protocols are the backbone of embedded systems, but choosing the wrong one can lead to headaches down the road.As engineers, we've all been there - debugging a sluggish I2C bus at 3 AM or wondering why our SPI sensor isn't responding. The truth is, each protocol has its sweet spot, and understanding when to use which one can save you countless hours of troubleshooting.UART / SPI / I²C side‑by‑side wiring overview

If you've ever stared at a microcontroller datasheet wondering whether to use UART, SPI, or I2C for your next project, you're not alone. These three serial communication protocols are the backbone of embedded systems, but choosing the wrong one can lead to headaches down the road.As engineers, we've all been there - debugging a sluggish I2C bus at 3 AM or wondering why our SPI sensor isn't responding. The truth is, each protocol has its sweet spot, and understanding when to use which one can save you countless hours of troubleshooting.The Serial Communication Landscape

Before diving into the comparison, let's understand why serial protocols matter. In embedded development, components need to talk to each other - microcontrollers to sensors, processors to memory, displays to controllers. Serial communication allows this data exchange using fewer wires than parallel interfaces, reducing PCB complexity and cost.Quick Protocol Overview

UART (Universal Asynchronous Receiver-Transmitter)

The Simple One: Point-to-point communicationWires: 2-3 (TX, RX, optional GND)Speed: Typically 9600 to 115200 baud, up to 1 MbpsAddressing: None - direct connection only

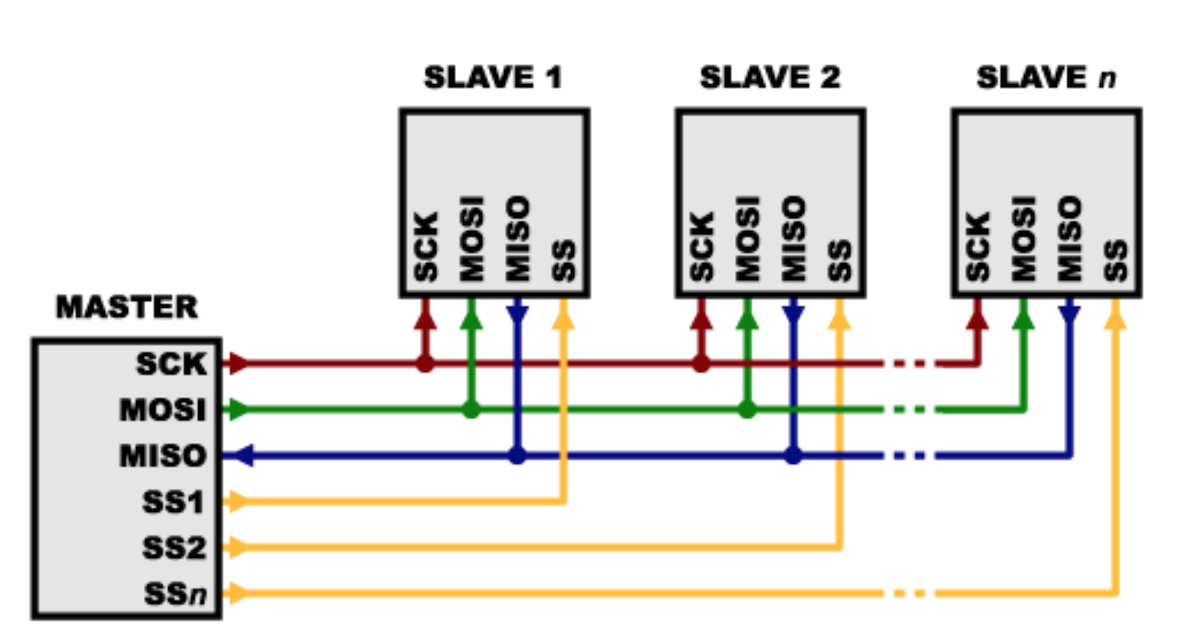

SPI (Serial Peripheral Interface)

The Speed Demon: High-speed, full-duplex communicationWires: 4+ (MOSI, MISO, SCLK, CS per slave)Speed: 10+ MHz common, can exceed 100 MHzAddressing: Chip select lines for each slave

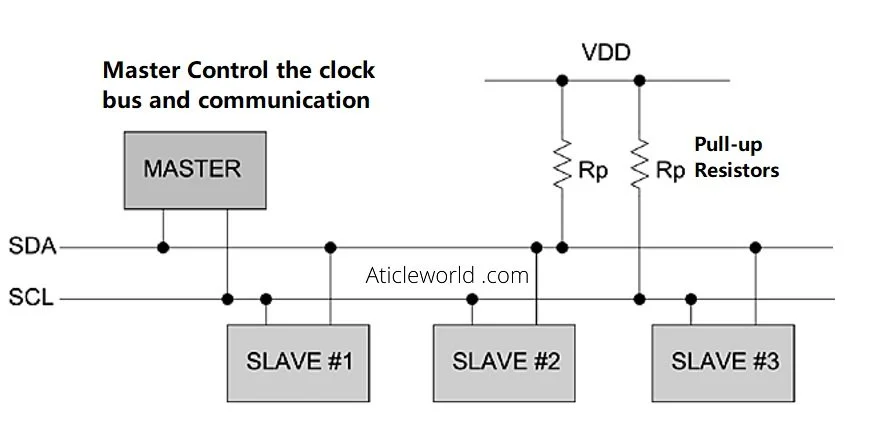

I2C (Inter-Integrated Circuit)

The Bus Master: Multi-device shared busWires: 2 (SDA, SCL) plus power and groundSpeed: 100 kHz (standard), 400 kHz (fast), 1 MHz (fast+)Addressing: 7-bit or 10-bit device addresses

The CHIPS Act Revolution: What It Means for U.S. Electronics Manufacturing in 2025

It all begins with an idea.

As a U.S.-based electronics manufacturer, the $52.7 billion CHIPS Act isn't just policy—it's a game-changer that's reshaping our industry. Here's what every engineer and hardware developer needs to know.

$39B in manufacturing incentives

25% tax credit for semiconductor investments

Expected supply chain improvements by 2026

New opportunities for U.S.-based hardware startups

What’s the Big Deal with the CHIPS Act?

If you work in electronics manufacturing or hardware development, you’ve probably felt the pain of chip shortages over the last few years. Whether it was waiting months for an MCU, dealing with skyrocketing prices, or scrambling to redesign a PCB around an alternative part, supply chain issues have been a headache for everyone.

That’s where the CHIPS and Science Act comes in. Passed in 2022, this $52.7 billion investment is the U.S. government’s attempt to bring semiconductor production back home, making the industry more resilient and less dependent on overseas fabs.

But what does this mean for engineers, startups, and manufacturers? Is this just another government initiative with no real impact, or will it actually change how we build electronics in the U.S.? Let’s break it down.

Why Was the CHIPS Act Even Necessary?

Back in the 1990s, the U.S. made nearly 40% of the world’s semiconductors. Fast forward to today, and that number has dropped to 12%—while countries like Taiwan, China, and South Korea have taken over the market.

This shift didn’t happen overnight. It was the result of:

Outsourcing for lower costs – Companies moved production offshore to stay competitive.

Massive government subsidies overseas – Taiwan and China heavily funded their semiconductor industries, while the U.S. didn’t.

Supply chain risks getting ignored – Until the pandemic, most companies didn’t think twice about where their chips came from.

Then COVID-19 hit, demand skyrocketed, and supply chains collapsed. Car companies halted production, electronics manufacturers scrambled for parts, and even defense contractors struggled to get the chips they needed.

The U.S. realized it had a major problem—so it decided to do something about it.

What’s in the CHIPS Act?

The CHIPS Act is basically a giant stimulus package for semiconductor manufacturing and research in the U.S. Here’s where the money is going:

1. $39 Billion in Manufacturing Incentives

Funding to build new semiconductor fabs in the U.S.

Grants and tax breaks for companies investing in domestic production.

Major chipmakers like Intel, TSMC, Samsung, and Micron are already planning new facilities in states like Arizona, Texas, and Ohio.

2. $13.2 Billion for Research & Development

Establishing the National Semiconductor Technology Center (NSTC) to push innovation.

Funding workforce training programs to grow the number of engineers and technicians in the semiconductor industry.

Investing in next-gen chip technologies like AI accelerators, RISC-V processors, and ultra-low-power semiconductors.

3. 25% Tax Credit for Semiconductor Investments

If a company spends money on chip manufacturing or equipment in the U.S., they get a 25% tax break—which could be a big deal for growing businesses.

4. $2 Billion for Defense & Critical Industries

Ensuring that military, aerospace, and high-tech industries have access to secure, U.S.-made chips.

How Will This Actually Impact Electronics Manufacturing?

More Chips, Fewer Supply Chain Nightmares

One of the biggest issues in electronics manufacturing has been long lead times for essential components. With more U.S. fabs coming online, we could see:

Shorter wait times for processors, microcontrollers, and FPGAs.

Fewer disruptions from international conflicts or trade restrictions.

More stable pricing over time, as local production increases supply.

Right now, we’re still a few years away from seeing the full effects, but the investment is a step in the right direction.

2. More Opportunities for Startups & Small Manufacturers

If you’re a startup working on AI chips, IoT devices, or custom hardware, this could be huge. The CHIPS Act includes funding for:

R&D grants to support new chip designs.

Partnerships with new U.S.-based fabs to get prototypes made faster.

Tax breaks that could lower production costs for small to mid-size hardware companies.

For years, many small hardware startups had no choice but to outsource manufacturing to China or Taiwan. With this new investment, it might finally make financial sense to keep production local.

3. More Onshore PCB Assembly & Electronics Manufacturing

Even though the CHIPS Act is focused on semiconductors, it will ripple across the entire electronics industry. As more chips are made in the U.S., we could see:

More domestic PCB manufacturing options.

Stronger local supply chains for parts and components.

More U.S.-based contract manufacturers expanding their capabilities.

This could be a game-changer for companies that want to proudly label their products “Made in the USA” without blowing their budgets.

4. More Jobs & Higher Demand for Engineers

With billions pouring into semiconductor manufacturing, companies will need more skilled workers to design, test, and build these chips.

Electrical engineers, embedded developers, and FPGA designers will be in high demand.

More apprenticeships and training programs will open up for engineers looking to get into the semiconductor space.

Long-term career growth in fields like AI chip design, high-performance computing, and custom ASIC development.

The Challenges & Unanswered Questions

Not everyone is convinced that the CHIPS Act is a silver bullet. Here are a few big concerns:

Fabs Take Years to Build – We won’t see real results until at least 2026 or later.

U.S. Labor Costs Are High – Even with incentives, U.S. production might still be more expensive than overseas manufacturing.

Global Competition Isn’t Slowing Down – China, Taiwan, and South Korea are still heavily investing in their own semiconductor industries.

While the CHIPS Act is a good first step, it’s only one part of the equation. U.S. companies will still need to stay competitive through innovation, efficiency, and smart supply chain strategies.

So, What’s Next?

The CHIPS Act won’t fix everything overnight, but it does mark a major shift in how the U.S. approaches semiconductor manufacturing. Here’s what to watch for:

More U.S.-based fabs coming online in the next 5-10 years.

PCB manufacturers and contract assemblers expanding their capabilities to support the industry.

More funding opportunities for startups working on next-gen chip designs.

Growing job opportunities for engineers in the semiconductor space.

For anyone in hardware development, embedded systems, or electronics manufacturing, this is the perfect time to:

Explore funding opportunities for R&D and prototyping.

Build relationships with U.S. semiconductor fabs for long-term supply chain stability.

Position your business to take advantage of “Made in the USA” incentives.

Final Thoughts

The CHIPS Act isn’t just a policy—it’s a game-changer for the future of electronics manufacturing in the U.S. While it has its challenges, it’s a big step toward making the supply chain more reliable, creating new opportunities for startups, and keeping innovation local.

What do you think? Will the CHIPS Act actually help the industry, or is it too little too late?